Carbon Tax: The Big Con

The Australian Government is pushing forward with a carbon pricing scheme, initially to be a “carbon tax,” eventually to become a “cap-and-trade” emissions trading scheme (ETS). But what does it mean and, more importantly, will it actually reduce carbon emissions? Or, instead, will it simply serve to fill Government coffers with a never ending supply of revenue that they can distribute in ways that will get them reelected.

That sounds cynical, particularly as so many high profile and presumably intelligent individuals are coming out in favour of this scheme, even though few details of how it will work have been revealed. To go against an idea that, if you believe the hype, will save save the planet would seem to make me a “evil polluting Neanderthal” — such a polarity of views is an important part of the playing of the new game in town… Carbon Tax: The Big Con.

If you haven’t seen it yet, the Australian Conservation Foundation (ACF) have recently produced a TV advertisment using high profile performers, to push the idea of the carbon tax. Using classic propaganda techniques and little in the way of fact, they want us all to sign up for this unexplained idea; they want you to sign a blank cheque and hand it to your local politician. Let’s take a look at their advert…

With grey skies (even though carbon dioxide is a colourless gas!), dirty smokestacks and emotive language the attempt to capture the thoughtless mind is evident. It’s first espousal, “Let’s make big companies pay!” is a classic attempt to hook your emotional mind by using your preconceived ideas and prejudices. Make ’em pay! That’ll learn ’em!

But guess what… many big companies got to be that way by shirking responsibilities and morality in the name of greed and shareholder profits — adding a new tax will not change that; nor will it take a single cent out of the pockets of corporate executives.

Companies will simply pass on the carbon tax charges to their customers. For example, airline passengers will have an additional surcharge added to their ticket price, along with the rest of the fees, taxes and surcharges that are currently added. Will one more fee change the number of people flying? Probably not.

When the price of fuel went above $1 per litre people cried out, complained, and swore that they would drive their cars less. Now, a couple of years later, with fuel regularly around $1.50 per litre we are driving (almost) as much as we were. While we may baulk at longer road trips because of the additional cost, we still need to drive to the shops; we still need to drop the kids at footy practice; we still need to visit Granma. In short, after an initial price shock, it is business as usual for our carbon-burning car. And there is no reason to suppose that our behaviour with a carbon tax will be any different.

So unless there is a HUGE price shock applied, carbon consumption is likely to be (almost) as much as it was before, and the Government will be raking in a vast new pile of cash through their new tax.

So unless there is a HUGE price shock applied, carbon consumption is likely to be (almost) as much as it was before, and the Government will be raking in a vast new pile of cash through their new tax.

If this money was directly and entirely used to support and develop low-carbon energy alternatives one could see that there would be a benefit. It is important, therefore, to ask: Where will the money go?

From the ACF advertisment we learn that some will go to renewable energy. Some? Why not all of it? If the stated intention is to reduce carbon why is not ALL of the money going to carbon reducing development? Renewable energy is an obvious target for the cash (if Australia can’t become the world leader in solar power there is really something wrong), but there are others too — improved public transport efficiency and infrastructure, for example, could result in large reductions in energy consumption throughout our communities.

But no, it seems that only some of your carbon tax money will go to reducing carbon.

(This is like companies that proudly state “a percentage” of the profits will be donated to charity. Do they think I am stupid? I know as well as they that 1% is every bit “a percentage” as 50%, and I guarantee that if they were donating 50% of the profits that is exactly what they would be saying.)

So where will the rest of the money go? Again, the ACF seems to have some ideas…

Yes, we know that the addition of a carbon tax will have a financial impact on individuals.

Yes, we know that the addition of a carbon tax will have a financial impact on individuals.

(Hang on, didn’t the ACF say that it would be “big companies” that would be doing the paying? It is hard to keep all of your lies straight once you start down that path!)

Of course, not all “families” will get this handout money. Nor, if you want to reduce carbon emissions, does giving a wad of cash to someone aid this goal. Does giving a family money to spend at the shops or throw down the guts of a poker machine help reduce carbon? (maybe, if it is not being spent on a new car!)

Lets look at the maths of the money…

(SOME for renewable energy) + (At least half for Struggling Families)

Does that account for ALL of the carbon tax money? Not necessarily; much is left unsaid and the hunt for a straight answer may be a long one.

By giving the Government control of the carbon tax they have no incentive to promote the reduction of carbon consumption, since it will net vast revenues; like renewable energy, this inexhaustible supply of cash will be theirs to apply when and where they wish.

Will giving the Government this slush fund encourage them to implement carbon emission reduction strategies? It hasn’t worked too well for gambling, alcohol or cigarettes, all of which are taxed by the Government. Taxing a vice removes all Governmental incentive to reduce those vices, other than the occasional and invariably ineffective showpiece project to make it look like they care. Carbon will be no different, and it may be that the imposition of such a tax actually prevents meaningful reduction in carbon emissions because the slush fund of money involved.

Airlines have a vested interest in following, understanding, and adapting to, whichever form of carbon pricing is introduced — both from a financial viewpoint and, of course, because reducing carbon emissions is the right thing to do. They really don’t need additional incentives like a carbon tax to encourage greater efficiencies — the high price of jet fuel does this automatically — but the European Union is still including the airline industry in it’s ETS as of next year. Other countries, including Australia, are looking at including aviation in a carbon pricing scheme.

Are there additional carbon savings to be made by taxing industries that already have a huge incentive to minimise carbon consumption, such as the airline industry? Unlikely — there is simply not a lot more that airlines can do that they are not already doing, and there is no greater incentive than a high fuel price. Further, any additional charges will simply be passed on to their passengers and, as a classic technique in tax avoidance, those that can will maximise off-shoring their operations to countries that do not have carbon pricing policies. This may result in reduced carbon tax revenues to the Government (and, of course, reduced income tax, GST etc. as homegrown employment is also minimised).

The thing is, if we are going to tackle the carbon problem head on lets do just that. Don’t lie to me about making evil companies pay when I know that it is me who will pay. Don’t lie to me about how this will reduce carbon when I know that it won’t. Don’t lie to me about the motives involved when it is obvious that most of the money will not be used to reduce carbon emissions.

Do the other political parties have any better answers? Not if their only goal is to stick their heads in front of cameras whenever they can simply to say “carbon is not a problem” or “battlers will pay.” Give me some real answers untainted by personal interest… that’s the kind of honesty this discussion requires.

If you really want to reduce carbon (and what right thinking individual does not), let’s do it right. Then, maybe, high profile and intelligent people will be able to proudly support a real plan rather than embarrassing themselves with such tripe as the ACF’s advert. It will take more that “the vibe of the thing” to solve this problem.

The carbon tax has the appearance of being the Biggest Con ever perpetrated on the Australian people. If rubbish like the “Say Yes” advertisement is to define our thinking on global warming, soon anyone who does not support a carbon tax will be labelled an “evil carbon-polluting empathiser.” — So endeth clear headed analysis and discussion… that’s the way propaganda works.

References:

Say Yes Australia

Australian Labor Party - Carbon Price Mechanism statement

ALP Carbon Price Mechanism policy document

Liberal Party Climate Change blog

ICAO - Environment Branch - Market Based Measures

Garnaut Climate Change Review (Ross Garnaut is the Australian Government’s principal climate change adviser)

The Garnaut Review does not say much about aviation, but here are some excerpts… see Garnaut Review, section 10.7

“Emissions would be attributed to countries on the basis of fuel purchase, and the fuel-supplying country would retain the revenue raised from the tax.”

“For aviation, imposition of a fuel tax might require an amendment to the Convention on International Civil Aviation. Aviation has a range of non-carbon dioxide climate impacts, such as the emission of nitrogen oxides and the formation of condensation trails and cirrus clouds. The IPCC (1999) estimated that total radiative forcing effects from aviation are about two to four times greater than those of the carbon dioxide from burning jet fuel alone. Measurement is complex and uncertain, and this issue may best be addressed after the establishment of an initial sectoral agreement.”

From another Garnaut report, (see chapter 21 - Transforming Transport):

“Based on the UK Government’s methodology for calculating emissions from flights for the purpose of offsets, a carbon price of $20 per tonne

CO2-e would increase the cost of a one-way flight from Sydney to Brisbane by $2.50 per passenger, and a price of $200 per tonne of CO2-e by around $25

(Department for Environment, Food and Rural Affairs 2008).”

From section 21.4.5 of that same document:

“In the short term, the emissions price is likely to have a smaller impact than higher fuel prices on aviation costs. Later in the century the

emissions price could have a more significant impact on the demand for aviation if low-emissions fuels have not emerged.”

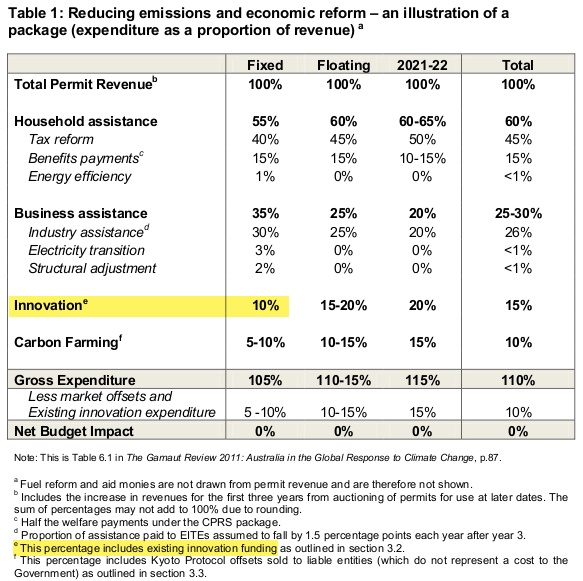

In the 2011 summary of his report Garnaut give a breakdown of where he recommends the money should go…

My comment: With regard to the “some” money spent on innovation, which is presumably the category under which renewable energy falls, it should be noted that the 10% of carbon tax revenue he recommends includes all current innovation spending. So, how much (or how little) is to be added from this vast income stream (estimated at $11.5 billion in the first year) to promote innovation in carbon-reducing technologies?

Recent Comments